How can you start going for a good investment financing that’ll not become causing monetary pain? A property financing specialist throws in their a few cents’ worthy of regarding the how to pick the best financing for you, additionally the key concerns to ask your own financial.

Investing in possessions might be a profitable strategy, nevertheless means tall financial resources, and if you are given investing in a home, getting a financial investment loan offer the administrative centre you really need to start-off.

But not, deciding on the best mortgage to suit your money spent tends to make every the difference regarding strengthening a profitable possessions profile.

To get another property is a small different to buying your first, since the you will online personal loans Missouri find even more to take into consideration when it comes to their approach and you may objectives, claims Bankwest Standard Movie director – Home buying, Peter Bouhlas.

With many financing options available, it can be challenging knowing how to proceed but Peter states starting the brand new groundwork to understand your current financial predicament was an effective put.

Whether it’s your first investment property otherwise you want to to add to the profile, they are questions to inquire about your own financial to find financing that is the proper fit for debt wants.

Do you know the most recent rates of interest?

.jpg)

The pace have a tendency to affect the overall count you pay more than living of the mortgage, and it may notably impact your profitability.

Interest rates getting capital funds are usually greater than men and women getting owner-occupied money, nevertheless they can vary significantly anywhere between loan providers, it is therefore essential to evaluate interest rates and you can research rates to own the best deal.

People seeking spend money on a rental possessions could find financial experts for the performing this, however, there are numerous a few, instance just what components possess higher tenant demand, additionally the additional interest levels readily available for buyers versus owner-occupiers, Peter says.

When you have numerous fund otherwise services, it will be worthwhile calling your own lender or broker, who’ll let give an explanation for processes and provide you with a thought from what your funds might look like once.

What financing options are offered?

Variable-rate fund are interested rate that can change-over date, when you find yourself fixed-speed finance provides a-flat rate of interest to have a certain months.

Each kind out of financing has its own benefits and drawbacks. Variable-speed loans offer independence minimizing first costs, when you find yourself repaired-price finance also have safeguards and you can certainty in terms of repayments.

Of these offered restoring, Bankwest’s Repaired Speed Home loan comes with the certainty from knowing what your interest rate and costs is, Peter explains.

Home owners can pick its fixed rate months from 1 so you can five decades, and you may payment regularity, become that each week, fortnightly or month-to-month, which can only help anyone carry out their budget.

Before you fix, Peter states it’s worth taking into consideration the brand new ramifications if you break the borrowed funds inside fixed several months, since the break costs you are going to incorporate.

Exactly what are the mortgage terms and conditions featuring?

Different loan providers offer additional mortgage provides that can apply to your loan’s liberty and you may total cost, such offset membership, redraw institution, split finance and you can portability (the capability to transfer your loan to another property if you sell a good investment).

In lowering your residence mortgage desire, you might want to hook up a counterbalance account to your mortgage or even be able to make extra money, Peter states.

Otherwise, to manufacture dealing with your bank account and you will cost management smoother, you might want significantly more flexible cost alternatives, the choice to split your loan ranging from fixed and you can adjustable, or even to consolidate your debts into the financial.

When you find yourself refinancing to another bank, you might also meet the requirements to claim cashback also offers, that may help counterbalance any additional charges otherwise financing place will cost you.

Which are the fees options?

An appeal-just loan will likely be an attractive choice for assets dealers just like the it permits to possess straight down repayments from inside the focus-only several months.

This may take back cashflow for investors to use for other investments or even to cover possessions expenses eg repairs or home improvements.

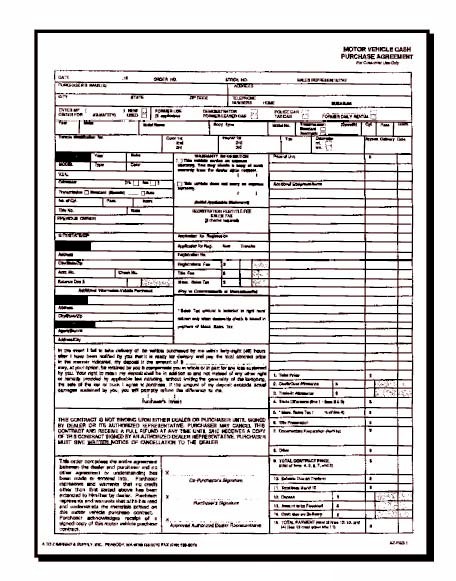

The brand new fees choice you choose gets too much to do with your total plan for forget the possessions. Picture: Getty

This can end in highest total attract can cost you over the life of your financing, while the initial money is lower.

Any alternative can cost you do i need to thought?

You will need to realize about the brand new initial will cost you that are included with to order an investment property given that factoring in costs away from put – for example regulators taxes – helps you stop unpleasant shocks.

This is certainly a state or territory government taxation that’s energized getting courtroom documents is stamped. The fresh new legislation to the stamp responsibility will always subject to transform, so it’s a good idea to look at the county or area government’s homes site for the most present pointers.

Peter states those individuals looking at to purchase a new assets enjoys unique considerations, instance leverage the guarantee within their latest collection and refinancing their existing money.

0 commentaires