Learn what is expected when making an application for possibly a mortgage or a good HELOC and what takes place next.

Whether or not a home loan are a repayment mortgage always buy property and you will a property equity credit line (HELOC) try good rotating credit safeguarded by your house’s collateral, the method to possess applying for this type of type of form of financing was contrary to popular belief comparable. Learn just what guidance and you will data files you will need to render in a choice of situation, also what takes place 2nd.

Just what information is necessary for mortgage and HELOC apps?

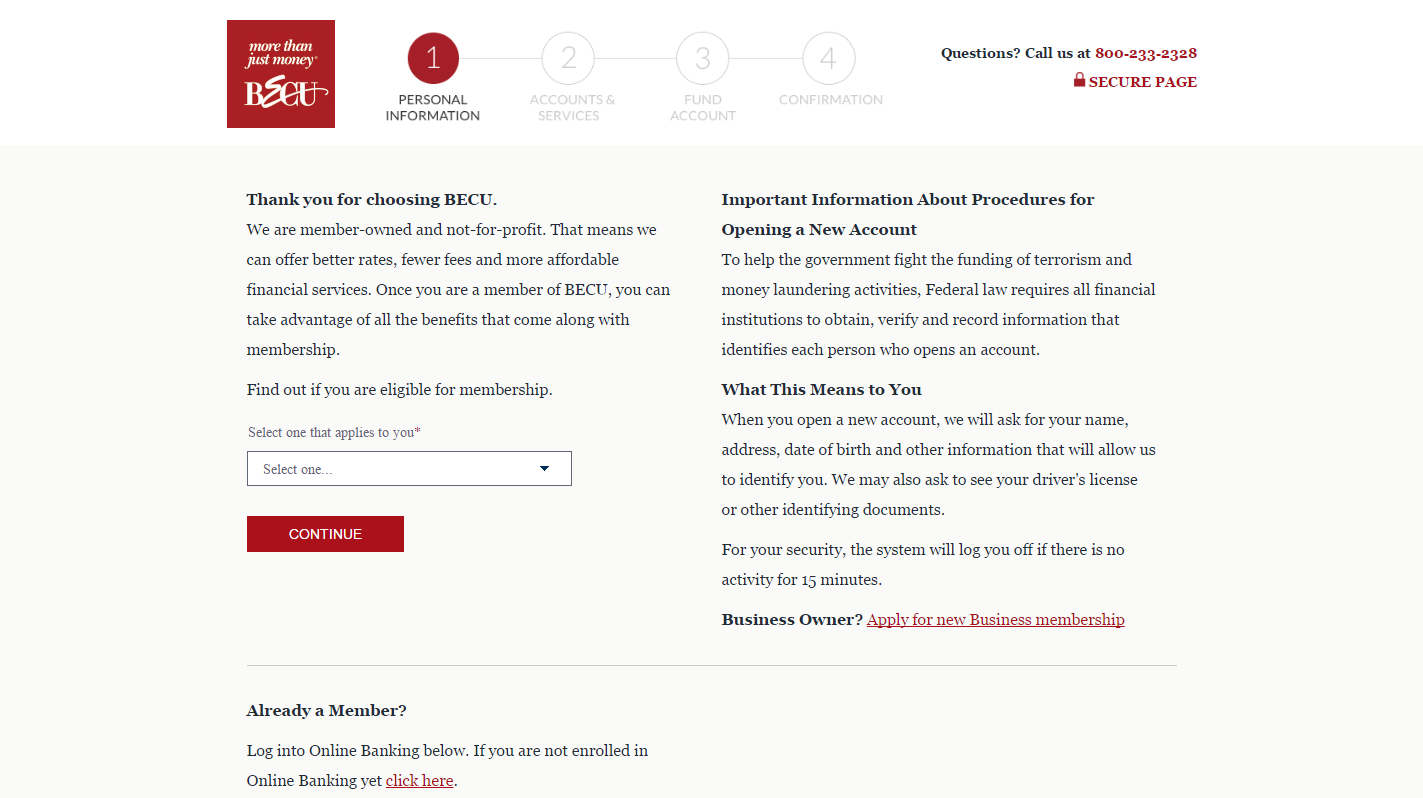

With a lot of associations, you might over and you will sign up for home financing otherwise HELOC online, over the telephone or even in individual during the a region branch. All the lenders use the exact same standardized Consistent Domestic Loan application (URLA, otherwise 1003 form) to own mortgages. HELOC apps elizabeth advice, that has the second in regards to you and you can one co-debtor (including a wife):

- Identification: Term, go out of delivery, social safety amount and you will driver’s license matter.

- Email address: Street address and telephone number.

- Mortgage consult: The quantity you would want to acquire in the home financing otherwise HELOC.

- Worth of: The purchase price for a mortgage or a recently available markets guess getting a HELOC.

- Employment: Employer’s identity and contact pointers, along with a career title.

- Income: Month-to-month earnings out-of efforts, youngster assistance, alimony and a residential property holdings.

- Assets: A list of all the lender and financial support membership, as well as checking, coupons, identity, broker, 401(K) and you may IRA membership, and their harmony.

- Costs and you will loans in Hanceville liabilities: A price out-of monthly costs, in addition to a list of liabilities (e.grams., playing cards and you can scholar otherwise car loans) with the outstanding harmony, payment and the months left to possess term fund.

Which have a mortgage, you usually need mean the source of your down percentage, if or not which is from the savings or it’s getting available with some one else. With a beneficial HELOC, anticipate to bring information regarding your existing financial, including the lender and its own newest equilibrium, additionally the label of your homeowners insurance company and your policy’s visibility limits.

What data are required to possess mortgage and you may HELOC applications?

When you fill out your own financial or HELOC application, be prepared to bring copies of one’s following the records so your bank is guarantee all the information on these groups:

- Identification: A government-issued images ID, such as your license.

In addition, attempt to express a signed copy of one’s get contract getting home financing application. For a good HELOC, duplicates ones type of documents are expected:

What’s the home loan and HELOC acceptance procedure?

Inside three working days off entry the application, lenders have to present financing Imagine (expected only for an initial mortgage or a predetermined HELOC), hence outlines an important standards and estimated costs of your mortgage or HELOC. To own a variable speed HELOC (such Quorum’s), loan providers are required to supply the following the disclosures (and inside 3 days):

What goes on immediately after you might be recognized to own a mortgage or a HELOC?

Immediately following you might be recognized, your own financial times financing closure and will be offering your that have a beneficial Closure at least about three working days before the day to have a first financial; to possess a beneficial HELOC, an effective HUD-step one Payment Statement is provided just before closure. One another outline the final terms of your mortgage otherwise HELOC and you will implies one funds you need to bring to closure and what finance would-be paid during they and whom, elizabeth.g., owner of the new house and you will/otherwise its mortgage lender through your financial closure.

If you’re planning toward obtaining a mortgage otherwise a HELOC a little while in the future, adopting particular simple fund cheats will change your credit rating and you will/or the DTI ratio, raising the chances you are recognized. This includes strengthening and you can sticking to a funds so that you real time within your setting in place of relying on handmade cards, particularly designating money into your funds to invest off people existing mastercard balances and you may using your bills promptly.

0 commentaires